Tokyu Real Estate Investment Management Inc. is an asset management company for Tokyu Real Estate Investment Trust, Inc.

Corporate Profile

Corporate Profile

- Corporate Name

- Tokyu Real Estate Investment Management Inc.

- Address

- Shibuya Mark City West 13th floor,

1-12-1 Dogenzaka, Shibuya-ku, Tokyo 150-0043, Japan

- Established

- June 27, 2001

- Business outline

- Financial instruments business (investment manegement)

- Capital stock

- 300 million yen (shares issued: 6,000)

- Representative

- Momoko Sasaki, Representative Director & President, Chief Executive Officer

- Shareholders

- Tokyu Corporation, 100%

- Number of employees

- 53

- Registrations and Licenses, etc.

- Financial Instruments Business Operators Registration: Kanto Local Finance Bureau (Kinsho), No. 360

Building Lots and Building Transaction Business License: Governor of Tokyo (5) 79964

Discretionary Transaction Agent License: The Minister of Land, Infrastructure, Transport and Tourism, No. 17

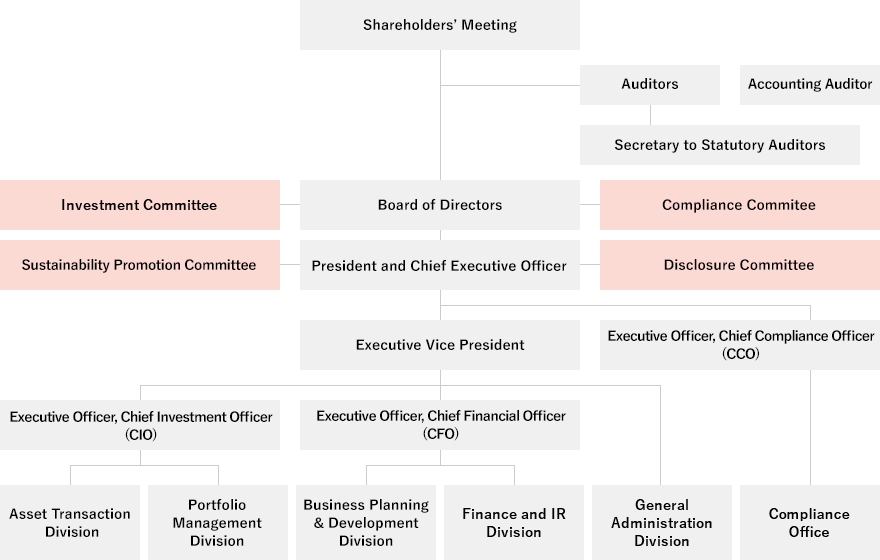

Organization Chart

Initiatives for Sustainability

Tokyu Corporation, the sponsor of TOKYU REIT, Inc. (“TOKYU REIT”), has for 100 years, since being founded, promoted sustainable urban development. This has been done by aiming to balance public and profit characteristics; in other words, both solving social issues and growing businesses with the development of public transportation and residential areas along the Tokyu railway lines as the two pillars.

This DNA is inherited by TOKYU REIT, which has been committed to sustainable investment management emphasizing growth potential and stability to be a 100-year REIT (a REIT that continues to grow over 100 years) since its establishment. Recognizing that ESG (environment, social and governance) and the SDGs (Sustainable Development Goals) are fundamental management issues for the sustainable growth of TOKYU REIT, Tokyu Real Estate Investment Management Inc. (“Tokyu REIM”) has established a sustainability policy that focuses on environmental considerations, social contributions, establishment of a governance structure, and ensuring transparency through information disclosure. Based on this policy, we will continue to identify material issues (materiality) for the economy, society, and the environment, and promote measures to resolve these issues.

Your continued support is greatly appreciated, as TOKYU REIT and Tokyu REIM remain committed to promoting our contributions to realize a sustainable society. At the same time, we aim to improve the value of our portfolio and to maximize unitholder value by establishing good relationships with stakeholders through dialogue and by contributing to value improvement in investment target areas.

May 2025

Momoko Sasaki, Representative Director & President, Chief Executive Officer

Tokyu Real Estate Investment Management Inc.

About J-REITs

A REIT is a financial product that invests funds collected from investors in a variety of commercial facilities, office buildings and other real estate with the aim of providing investors with rental revenue from those properties and gains on sales of real estate.

Originating in the United States, REIT is an acronym for real estate investment trust. Subsequently, this became known as J-REIT in Japan, with the “J” standing for Japan.

J-REITs are a type of investment trust and are listed on stock exchanges. The first J-REITs were listed in September 2001, and TOKYU REIT, Inc. was listed on the Tokyo Stock Exchange in September 2003.

J-REITs issue investment securities (equivalent to the stock certificates of publicly traded companies) that are purchased by investors or bought and sold in the J-REIT market just like stocks. Investing in J-REITs is a way to indirectly invest in real estate. Going forward, the J-REIT market is expected to grow even further.

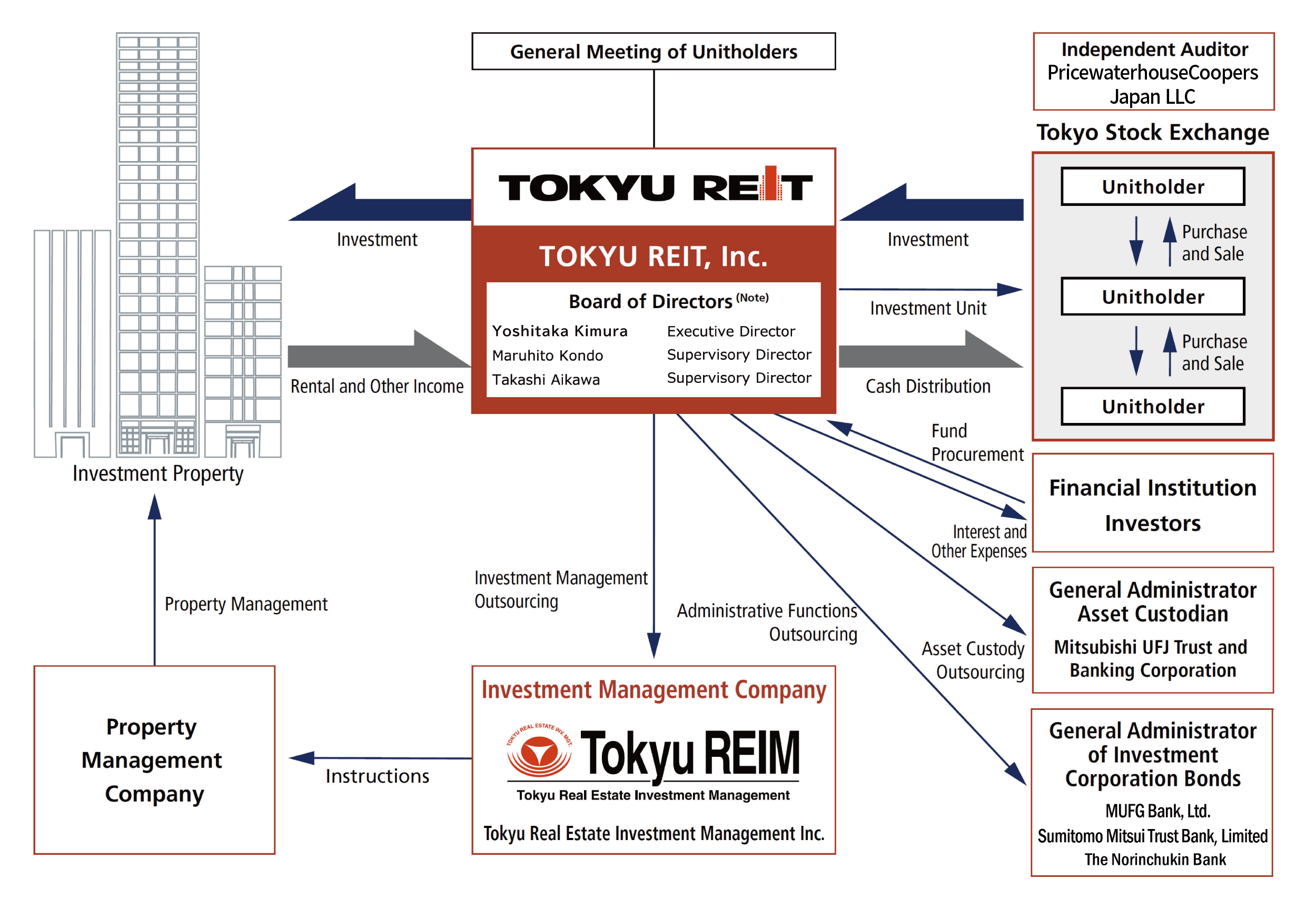

How J-REITs Work

The Act on Investment Trusts and Investment Corporations (Investment Trust Law) stipulates that investment corporations outsource the selection of real estate and investment decisions and have no employees. The investment corporation has only executive and supervisory officers, and outsources real estate selection, investment decisions, and other general administrative tasks to an asset management company that is an external financial instruments business operator.

Tokyu REIM entered into an entrustment for asset investment agreement with TOKYU REIT, Inc., as an asset management company entrusted with the following duties.

- All duties related to the management of the investment corporation’s assets (including making all decisions regarding the sale and purchase, exchange, or leasing of residential land or buildings, and acting as a proxy or intermediary for these transactions based on these decisions).

- All duties related to fund procurement by the investment corporation.

- All duties related to reporting to the investment corporation.

- All other duties related or incidental to (1) through (3) above that the investment corporation outsourced as needed.

- In addition, appointment of Taisuke Inoue as a substitute executive director was approved at the General Meeting of Unitholders of TOKYU REIT held on April 18, 2025.